Tackling cost and improving outcomes in U.S. healthcare with the latest in AI and big data

AI and big data will help us tackle the greatest challenges in healthcare and biotech and will fundamentally change how we diagnose, treat, manage and deliver healthcare, cure disease and discover new drug therapies.

Today AI is evolving at an unprecedented pace and is already changing how we work and live. While some industries will adopt the latest AI capabilities rather quickly, the fragmented, legacy healthcare industry will take more time to adopt AI capabilities at scale due to regulatory complexities, complex interconnected systems with varying processes and policies, disparate structured and unstructured data, thousands of EHR vendors, and business and policy-related challenges - among other challenges.

The AI/ML and data capabilities to address many of the healthcare systems challenges are already available.

To meaningfully tackle healthcare challenges, an immense amount of data storage, compute, autonomous AI agents, and the ability for AI to accurately process multimodal data is required. Only recently has this become possible. Healthcare data is highly multimodal which includes medical images (MRIs, CT scans), sensor data from wearable devices and EHRs, audio recordings (heart sounds, patient interviews), text (clinical notes), videos (surgical videos) and omics data (genomics). Healthcare data will only continue to get more complex and organizations will continue to add large volumes of data in disparate software systems.

U.S. healthcare is at an inflection point

he implications are massive with healthcare costs soaring to record heights, low productivity growth, clinician burnout, an aging population, capacity constraints, and frustrated patients who, on average, are in poorer health than pre-pandemic levels. This has put an unprecedented demand on the entire healthcare system across providers, hospitals, payors, pharmaceutical firms, manufacturers, and service providers.

Rising healthcare costs

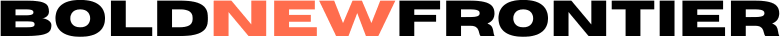

Healthcare spending has surpassed GDP growth since 2010, 4.6% to 1.9%, and PWC projects the group market to increase by 8% and the individual market to increase by 7.5% year-on-year in 2025 - far surpassing inflation which currently sits at 2.8%.

Persistent workforce shortages

The U.S. could see an estimated shortage of between 37,800 and 124,000 physicians by 2034, across both primary and specialty care, according to the Association of Medical Colleges. We may face a shortage of nurses between 200,000 to 450,000, according to McKinsey. This shortage is driven by unmanageable workloads, provider burnout, excessive administrative tasks, and feelings of being undervalued among healthcare professionals.

The average physician works between 51 to 60 hours a week with 5% averaging 80 hours or more, according to the American Medical Association. Unfortunately, this has led to more medical errors and poor patient outcomes.

A large, aging population

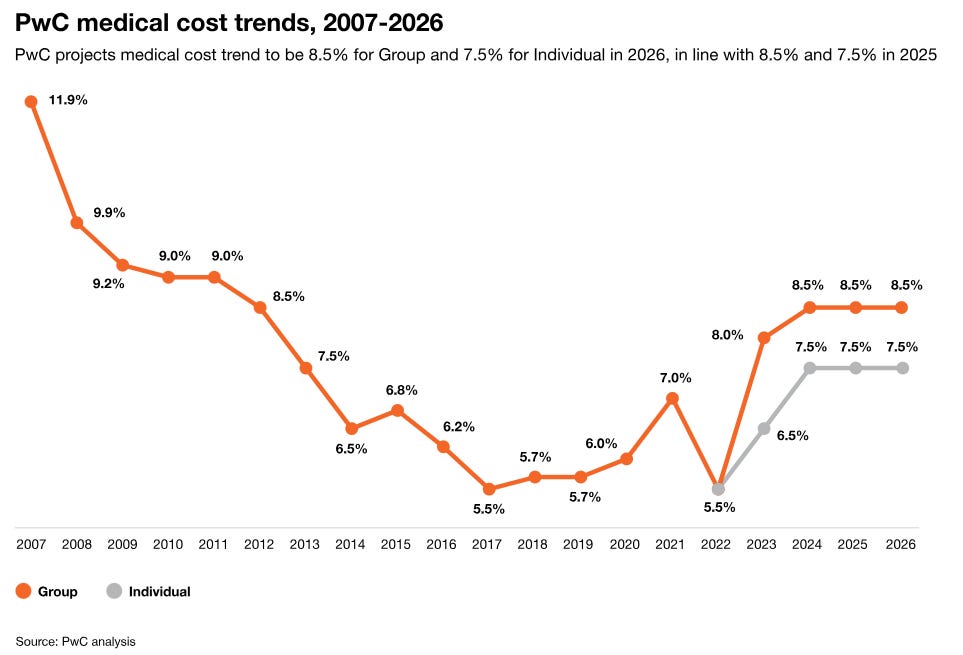

The United States’ population is aging rapidly due to two interrelated factors. The first, the increase in life expectancy which is estimated to increase from an average of 78 to 86 for males and 80 to 88 for females between 1943 and 2053. Life expectancy increased by an estimated 0.18% just between 2024 and 2025. The second, baby boomers, who make up the largest cohort in U.S. history with 73 million Americans, have reached retirement age. As this cohort reaches retirement age, the proportion of the population aged 65 and older will rise substantially, increasing from 17% in 2022 to 21% in 2030 and 23% in 2050.

Rising chronic illnesses

According to the American Hospital Association, today nearly half of the population, approximately 133 million Americans, suffer from at least one chronic illness which is 15 million higher than a decade ago. By 2030, it’s expected that 170 million Americans will meet this criteria.

Growth across healthcare segments

The U.S. healthcare profit pool is estimated to grow at a 7% CAGR, from $583 billion in 2022 to $819 billion in 2027, according to McKinsey.

Several segments are expected to see higher growth in profit pools:

Outpatient care settings such as physicians offices and ambulatory surgery centers

Pharmacy services, especially specialty pharmacies

Healthcare software and platform businesses

Elder care and home assistance care

The demand for change is profound

As healthcare spending has skyrocketed, we’ve actually done less with more capital. Among healthcare industry professionals there is an immense appetite for change. For patients, demand for change has reached new heights. While the frustration is nothing new, recent events and press has led to a public outcry and an intense focus on the U.S. healthcare system and insurance industry.

How tech is addressing these problems

AI agents and workflows reducing administrative burden

Over the past decade, provider margins have shrunk from 10% to a low of 1-2% as claim denial rates have nearly doubled from 7% to over 13%. Administrative costs account for over one third of total provider costs. AI agents and workflows and API-based services can automate repetitive administration tasks with claims processing, billing, scheduling, charting, medical coding, and EHR data entry as well as maintaining compliance and policy standards. Vertical, highly domain-specific solutions will vastly better serve healthcare customers than horizontal solutions. A popular use-case is recovering revenue for providers from unpaid and denied claims from payors - referred to as revenue cycle management (RCM). The value proposition is strong. If adopted, this technology can reduce costs, the administrative burden for providers, while increasing revenue recovery, and in turn reduce burnout and enable providers to spend more time on patient care. Additionally, many use-cases can improve labor productivity across both administration and care delivery workflows.

Relevant startups: Sohar (Pre-Seed), Circle Health (Seed), Irismed (Pre-Seed)

AI co-pilots and advanced, real-time analytics for providers

AI and advanced analytics can significantly improve diagnostic accuracy and improve the overall quality of care. According to Harvard, AI in medical diagnosis can reduce treatment costs by 50% and improve health outcomes by 40%. Additionally, AI-driven co-pilots can assist providers with curating patient data, suggesting treatments, and facilitating personalized patient care by providing contextualized insights in real-time. By tapping into an extensive, HIPAA-compliant dataset of patients with similar characteristics, this tech can help doctors make more data-informed decisions and help determine what the best course of action might be in real-time.

Relevant startups: Future Clinic (Pre-Seed), OPCI (Seed)

Connected platforms for elder care

Delivering care in clinics, hospitals, and other in-patient facilities is expensive and requires an extensive workforce (read above: shortage looming). Home-based care or mobile monitoring, particularly for the elderly, is not only more desirable and convenient for patients, but lends itself to less costly, more personalized care. Digital care platforms that can help nurses or loved ones manage, monitor and coordinate care will be a major area of opportunity as the U.S. population continues to age. Particular technologies such as AI chatbot that orchestrate family and caretaker communication, remote patient monitoring, predictive analytics, and caretaker coordination (e.g. shift scheduling, patient profiles, documentation) have continued to gain traction.

Relevant startups: Telly (Pre-Seed), Concierge Care (Pre-Seed), Eldera (Seed)

Precision and personalized medicine

Advancements in stem cells, gene editing, biomarker discovery, and robotics have landed biotechnology in a new age. With AI and big data there is a stronger feedback loop which in turn improves the predictive power of AI. Companies leveraging genomic data and predictive analytics are developing personalized therapies and tailored treatments based on a patient's unique genetic makeup, biomarkers, lifestyle factors and medical history presenting an incredible opportunity. However, rather than rules-based automated workflows only true AI algorithms with high-quality, error-free datasets that adapt and learn are required to truly unlock new realms of precision medicine and drug discovery. Investments should have a de-risked regulatory path and be in the clinical stage.

Relevant startups: ArgenTag (Seed) GeneHub (Seed)

Interactive mental and behavioral health solutions

There’s little doubt that mental health in the U.S. has reached a crisis point. Mobile platforms, chatbots, and other applications have seen adoption among individuals, universities, and employers. A recent study found that clinical trial patients chatting with the Therabot app saw a 51% drop in depression symptoms and a 31% drop for anxiety. However, to be successful, user adoption and patient outcomes are critical.

Relevant startups: Lucero (Seed), Integral Health (Seed), Ollie (Seed)

AI/ML for early detection and diagnostics

Highly trained AI diagnostics platforms can help physicians analyze medical imaging, genetic data, blood, ECG data, and even voice data to detect disease and health complications early on. In the case of cancer, early detection makes a critical difference. According to the American Cancer Society, the 5-year survival rate for melanoma, an aggressive form of skin cancer, is 99% when localized but drops to just 32% for cancers that have spread to distant areas, demonstrating the criticality of an early diagnosis. Outside of cancer, these systems are particularly promising for neurological disorders, heart disease, and other life threatening conditions.

Relevant startups: Autonomic Health (Pre-Seed)

Preventive healthcare platforms for patients

Preventative care reduces the likelihood and severity of extensive, catastrophic medical claims and improves health outcomes. According to a study conducted by USI, preventive care measures reduced emergency room visits by 40%, reduced in-patient hospital stays by 33%, and helped patients save 3-5% on annual healthcare premiums. Digital platforms and various technology innovations can proactively reach out to patients, assess patient health using multimodal data including demographic, genetic, environmental, and activity information to make data-driven recommendations for the patient and connect them with local providers. This is especially useful for aging and rural populations as well as patients with a high-risk health history.

Relevant startups: Recursive Health (Pre-Seed)

Qualities of successful healthtech teams

Founder-market fit with deep healthcare expertise

For a company to scale and win the market, founders need deep healthcare or biotech industry experience and expertise. Companies without founder-market fit will have an incredibly difficult time navigating the healthcare system due to its highly technical nature, regulatory landscape, fragmentation, and legacy processes. The founding team needs to have a unique vantage point to solve a given problem in healthcare and a distinctive obsession to do so.

A pattern of progress and momentum

It’s ideal to meet entrepreneurs early in their journey and watch how they perform. Even for pre-seed and seed stage companies, traction is a necessary component of evaluating an investment. It’s not a requirement for a company to prove it’s “killing it” overnight, but a clear trajectory of progress builds investor confidence. Progress can be in the form of ARR, product, partnerships, adoption or other means which sends a strong signal that the company isn’t standing still and is on track for success.

High-agency and urgency

The most effective founders act with urgency. From the time a company starts, founders are on the clock to make the company work. Not moving with urgency can kill fundraising, lose potential customers, and send a weak signal to partners. The most effective founders I’ve worked with take extreme ownership, have a bias for action, and act with urgency. ARR milestones are reached faster than ever before because of AI due to automation and AI-enhanced go-to-market strategies.

Market size and a growth mindset

Clearly market size is critical for investments in companies that will provide the returns venture requires. Many market sizing slides in pitch decks are poorly executed. A bottoms-up approach with precision is preferable to a top-down process or a large number that demonstrates market size.However, the initial market doesn’t have to be huge. In fact, it can be quite focused. What’s important is that founders need to have conviction of a vision and a strategy to scale the company to a larger total market. This can be done by developing more features to serve a more diverse set of customers or expanding services at current target customers. Here, a growth mindset is critical.

Timing: matching the solution with market signals

The healthcare and biotech industries are diverse with numerous subsectors, stakeholders, and potential customers. Depending on the specific market, target customer, and product offering, the right timing to start the company varies. I believe the opportunities above have opportunistic timing now or in the near future. Investing in the right company at the wrong time is the wrong investment. Market signals should be strong and founders should closely track them.

Sell the “vision” and ability to raise capital

Each company should have at least one founder who can sell the vision of the company, build trust with investors, and have the resourcefulness to raise future rounds. Even with an incredible product or customer base, early-stage companies fail when they’re unable to raise future rounds to fuel continued growth.

What it takes to win in healthtech

Adoption

Possibly the biggest moat in healthtech is adoption - once a subset of the market standardizes a solution, it becomes the standard. Founders need to build the product clinicians, physicians and other healthcare professionals want and need. Being stitched into healthcare and administrative workflows is key for retention and growth. The stickier the product, the greater the customer retention will be.

Data competitive advantage

While healthcare is known for its siloed, fragmented, and unstructured data problems, this presents a unique opportunity. Companies can develop a data advantage by acquiring a unique and valuable dataset by collecting customer data or through key partnerships or purchase agreements with hospital networks, insurance companies, universities, or private and public researchers. Platforms that create an ecosystem over time can acquire a significant amount of proprietary data.

Distribution through channel partnerships

Over the last decade, healthtech companies have failed to achieve escape velocity because they fall short of developing a sustainable path for distribution. The healthcare ecosystem is vast and deeply interconnected. Developing rich partnerships through mutual value creation can create a strong GTM pipeline to successfully acquire more customers. For example, partnering with payors can help reach providers and employers.

Integration and “platform-ability”

For companies to make implementation and adoption feasible, integration with widely used IT systems, particularly EHR and EMS systems like Epic and Cerner/Oracle Health is key. Hospitals and health systems are searching for ways to augment their current systems and IT infrastructure, rather than purchasing an independent platform. Embedding the company’s software into a customers’ core workflow will help it become an essential part of their tech stack and care delivery. As the company scales and continues to build out its product, this will present the opportunity to layer additional services and diversified components, growing its revenue and service footprint.

Technological sustainability

Healthcare organizations tend to stick with technology vendors for many years. Companies must develop a robust, future-proof architecture that is built to last and support future product development and evolving security requirements. Not focusing on technical leadership and sustainability in the company’s earliest days can be a fatal mistake.

Timeline and other considerations

While consumer apps in the mental health space can expect a shorter cycle for adoption, large-scale adoption for health systems, clinics, and hospitals for AI and big data products should expect approximately a 5 - 10 year timeline as the U.S. healthcare system continues to evolve and legacy systems are challenged.

However, the time to start building is now. Large hospitals and health systems are already looking for ways to augment their current systems with emerging capabilities that AI/ML and big data offers. Approaching providers with solutions for their immense challenges, as mentioned above, is an excellent value proposition.

Startups must carefully design their solutions around existing constraints in hospitals and clinics. These constraints include budgets, regulation/compliance, organizational policies, current IT systems, and the resources needed to implement new systems and workflows. Some early-stage companies may find co-developing a product with a healthcare system or hospital may lead to the best outcome.